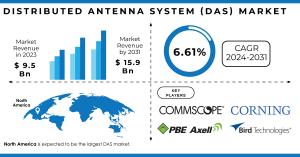

Distributed Antenna System Market to Cross USD 15.9 Billion with Highest CAGR of 6.61% by 2031: SNS Insider

Distributed Antenna System Market Size, Share, Growth Drivers and Regional Analysis, Global Forecast 2024 - 2031

AUSTIN, TEXAS, UNITED STATES, May 22, 2024 /EINPresswire.com/ -- Market Size & AnalysisThe Distributed Antenna System (DAS) Market is poised for exceptional growth, as indicated by the SNS Insider report. Market size, valued at USD 9.5 billion in 2023, is projected to reach USD 15.9 billion by 2031. This expansion reflects a robust CAGR of 6.61% over the forecast period (2024-2031).

DAS technology is essential in a world where users expect flawless wireless connectivity indoors and in densely populated areas. Large cellular towers, while critical for long-range transmission, cannot guarantee uniform mobile coverage within built-up environments. DAS elegantly solves this issue by extending the reach of the network and minimizing dead zones, creating a consistent connectivity zone for a wide range of end users.

The commercial sector, including stadiums, shopping centers, and transportation hubs, is a major locus of DAS deployment. The Asia-Pacific region, propelled by rapid urbanization and economic expansion within ASEAN nations, is witnessing an unparalleled expansion of commercial space, fueling the demand for superior wireless solutions.

Download Free Sample Report with Full TOC & Graphs @ https://www.snsinsider.com/sample-request/1830

KEY PLAYERS:

- CommScope

- Corning

- PBE Axell

- Bird Technologies

- Advanced RF Technologies

- Connectivity Wireless

- Comba Telecom Systems

- SOLiD Technologies

- American Tower

- AT&T

- Boingo Wireless

- Dali Wireless

- Zinwave

- Whoop Wireless

- HUBER+SUHNER

- JMA Wireless

- Galtronics

- Betacom

The insatiable demand for seamless, high-capacity data transmission underpins the growth trajectory of the DAS market.

Consumers and businesses alike rely more heavily on connected devices and bandwidth-intensive applications. DAS technology, with its ability to enhance coverage and capacity in challenging environments, is crucial to meeting this rising demand. Small-cell networks, integral to boosting network density, are heavily reliant on DAS architecture to ensure widespread signal distribution. The result is a vastly improved connectivity experience.

The DAS market is a dynamic environment, with key developments further strengthening its growth

• In January 2023, Wilson Electronics' acquisition of Zinwave Communications, a leader in ultra-wideband RF over fiber solutions, expanded the addressable market for both companies globally.

• In June 2022, Comba Telecom Systems Holdings Limited launched its 4G/5G (8TR) Green Integrated Base Station Antenna to aid operators in achieving carbon neutrality ambitions.

• In December 2022, Boingo Wireless deployed a comprehensive Wi-Fi network for the Armed Forces Recreation Center (AFRC) Edelweiss Lodge and Resort in Germany, ensuring connectivity for guests.

• In August 2022, Corning Incorporated bolstered its optical cable manufacturing capacity to meet the ever-increasing demand for network infrastructure in the US.

KEY MARKET SEGMENTS:

By Offering, the service segment dominates the market due to the essential role of expert installation. Both manufacturers and system integrators are vital in offering comprehensive installation expertise.

By Ownership Model, the neutral-host ownership model holds the majority share. This model offers multiple carriers cost-effective access to improved infrastructure, benefiting service providers and end-users.

By Signal Source, the commercial vertical leads the market, with increasing mobile data traffic and IoT adoption in commercial spaces driving DAS demand.

Make an Enquiry Before Buying @ https://www.snsinsider.com/enquiry/1830

Economic Slowdown and Global Conflict

- Economic slowdowns can temper market growth, potentially impacting infrastructure investments. However, the essential nature of connectivity likely offers a degree of resilience to the DAS sector, with demand expected to sustain its general upward trajectory.

- The ongoing conflict between Russia and Ukraine presents logistical and supply chain challenges. Certain materials and components vital to DAS production may experience disruptions. Additionally, international sanctions can impact trade flows and investment patterns in the telecommunications sector.

North America accounted for the largest share of the DAS market in 2023.

This dominance stems from the region's embrace of Bring Your Own Device (BYOD) policies, its investment in smart city infrastructure, and ever-increasing smartphone usage. North America's pioneering role in telecommunications technology has resulted in early adoption and robust investment in DAS solutions, leading to substantial market share.

China is a major player in the Asia Pacific DAS market, holding the largest share for both services and components in 2023 and expecting to maintain this dominance. This is fueled by aggressive 5G development spearheaded by telecom giants like Tencent, Baidu, and Alibaba. Additionally, China's massive population and high internet usage rates drive sustained demand for reliable connectivity, making DAS technology essential.

Key Takeaways for the Distributed Antenna System (DAS) Market Study

• The insatiable demand for reliable, high-speed wireless connectivity is the primary driver of growth within the DAS market.

• Businesses, stadiums, transportation hubs, and other commercial spaces are major adopters of DAS solutions to meet rising connectivity needs.

• Market growth and leadership are shaped by region-specific factors such as technology adoption rates, infrastructure investment, and BYOD policies.

• China's massive population, rapid 5G development, and high internet adoption rates make it a crucial player in the DAS market, specifically within the Asia Pacific region.

Table of Content – Analysis of Key Points

Chapter 1. Executive Summary

Chapter 2. Global Market Definition and Scope

Chapter 3. Global Market Dynamics

Chapter 4. Distributed Antenna System Market Impact Analysis

Chapter 4.1 COVID-19 Impact Analysis

Chapter 4.2 Impact of Ukraine- Russia war

Chapter 4.3 Impact of ongoing Recession

Chapter 5. Value Chain Analysis

Chapter 6. Porter’s 5 forces model

Chapter 7. PEST Analysis

Chapter 8. Distributed Antenna System Global Market, by Offering

Chapter 9. Distributed Antenna System Global Market, by Coverage

Chapter 10. Distributed Antenna System Global Market, by Ownership Model

Chapter 11. Distributed Antenna System Global Market, by User Facility Area

Chapter 12. Distributed Antenna System Global Market, by Frequency Protocol

Chapter 13. Distributed Antenna System Global Market, by Network Type

Chapter 14. Distributed Antenna System Global Market, by Signal Source

Chapter 15. Regional Outlook

Chapter 16. Competitive Intelligence

Chapter 17. Key Companies Analysis

Chapter 18. Research Process

Continued…

Buy Single User License @ https://www.snsinsider.com/checkout/1830

Contact us:

Akash Anand

Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

Read Related Reports:

Data Center Power Market

Super Capacitors Market

Power Semiconductors Market

Akash Anand

SNS Insider Pvt. Ltd

+1 415-230-0044

info@snsinsider.com

Visit us on social media:

Facebook

Twitter

LinkedIn

Instagram

YouTube

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.